retroactive capital gains tax history

Donors will be able to give gifts without realization if the estate provisions take effect after 2021. Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic.

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

One of the big surprises included in President Joe Bidens first budget is the retroactive application of the near 100 capital gains tax hike.

. Biden plans to increase this to 434 percent for households earning more than 1 million. Biden calls for his capital gains tax proposal to be retroactive. A historical review suggests that any tax legislation enacted in 2021 could have retroactive effect to transactions.

A true tax hike. In addition the proposal specifies the change will take effect retroactive to September disallowing investors from selling their position before the. May 28 2021 at 359 pm.

The following state regulations pages link to this page. Another would raise the capital gains tax rate to 396 for taxpayers earning 1 million or more. Individuals would have a 1 million exclusion for capital gains and an additional exclusion of 500000 for a personal residence.

Retroactive Tax Increases and The Constitution This lecture was held at The Heritage Foundation on April 15 1998. CNBCs Robert Frank reports. In any case.

In 1969 during Richard Nixons administration Congress passed the Tax Reform Act of 1969 which raised certain income tax rates with at least twenty retroactive effective dates. Since 1993 investors in Qualified Small Businesses have been able to exclude 50 of their capital gain from federal taxes. Retroactive tax provisions in 1969 1987 and 1993 withstood constitutional challenges in part because they were designed to create more taxpayer equity and to eliminate loopholes.

While the most significant recent capital gains rate change provided by the JGTRRA was largely. With this retroactive income tax hike the White. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after April 2021.

Financial advisers say Bidens retroactive capital-gains tax hike gives them wiggle room Last Updated. This proposal would be retroactive to the beginning of 2021. If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase.

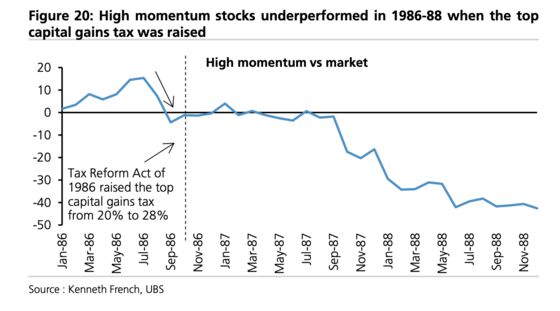

May 31 2021 at 1250 pm. I looked in a number of books for a good joke about taxes but I couldnt find any. A report by the Tax Policy Center shows that capital gains realizations rose by 60 percent in 1986 before the new tax rate of 28 percent was due to come into effect in 1987 from the previous 20 percent.

In recent years such retroactive rate changes have occurred as late into the year. History Set forth on page 62 of the Green Book tax is the proposal we have all heard about the increase in the capital gains tax rate that will raise the top rate for households earning more than 1 million to 434 a number that includes an existing 38 surtax to help pay for the Affordable Care Act from the current 238. Explanation of the Constitution - from the Congressional Research Service.

But prior to such legislative change could be subject to a higher capital gains rate. A Retroactive Capital Gains Tax Increase. President Joe Biden is formally calling for his proposal for the largest capital gains tax in history to be retroactive.

Financial advisers say Bidens retroactive capital-gains tax hike gives them wiggle room Last Updated. Two policy experts debate the effectiveness of Elizabeth Warrens tax plan. Moreover it is doubtful that any change to the capital gains tax rate will be retroactive.

In 1969 during Richard Nixons administration Congress passed the Tax Reform Act of 1969 which raised certain income tax rates with at least twenty retroactive effective dates. Biden calls for his capital gains tax proposal to be retroactive. Still another would make the change.

When taxes go up investors naturally rush to realize their gains at the lower tax bracket before the hike takes effect. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of. This percentage was bumped up to 75 in 2009 and then 100 in 2010.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1. An economist explains the macro. If you live in a state that taxes capital gains youre going to see an additional tax on top of it leaving certain individuals with marginal capital gains rates past 40.

Completed at any time in 2021. 28 greater if and when the capital gains tax increases. Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year.

1st Retroactive Capital Gains Increase in US. The purpose of the tax exemption is to promote investment in small innovative businesses that are scalable and would ultimately create more American jobs. But additionally he wants this implemented retrospectively to April 2021.

While the most significant recent capital gains rate change provided by the JGTRRA was largely prospective it was still in part retroactive and included a complicated transition rule that. Similarly widespread exits jumped 40 percent.

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

Biden Tax Plan And 2020 Year End Planning Opportunities

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Tax After Coronavirus Treasury Committee House Of Commons

Managing Tax Rate Uncertainty Russell Investments

If The Build Back Better Bill Does Pass In 2022 Will The Capital Gains Qsbs Changes Still Be Retroactive To 2021 R Fatfire

Managing Tax Rate Uncertainty Russell Investments

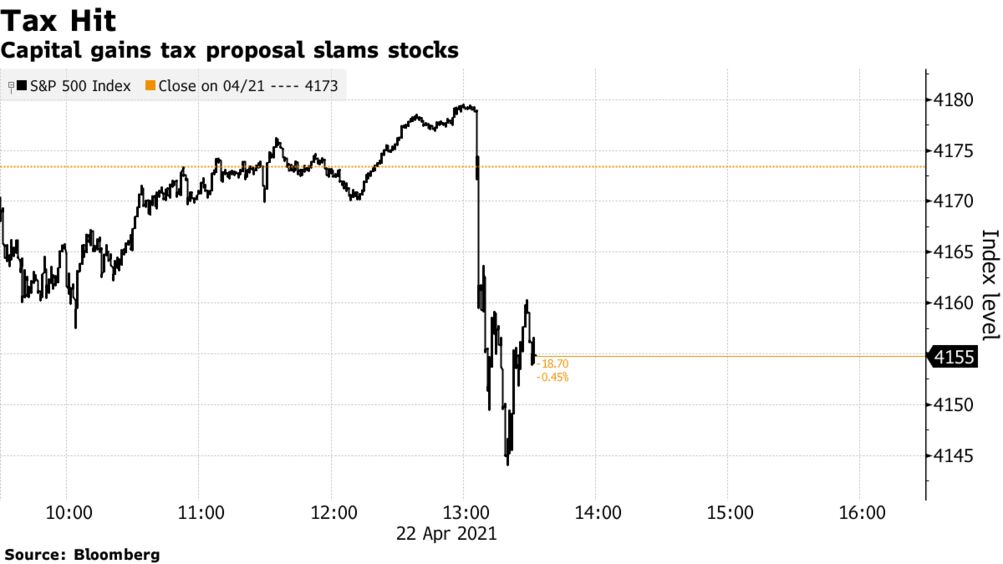

Wall Street On Tax Plan It Will Incentivize Selling This Year Bloomberg

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

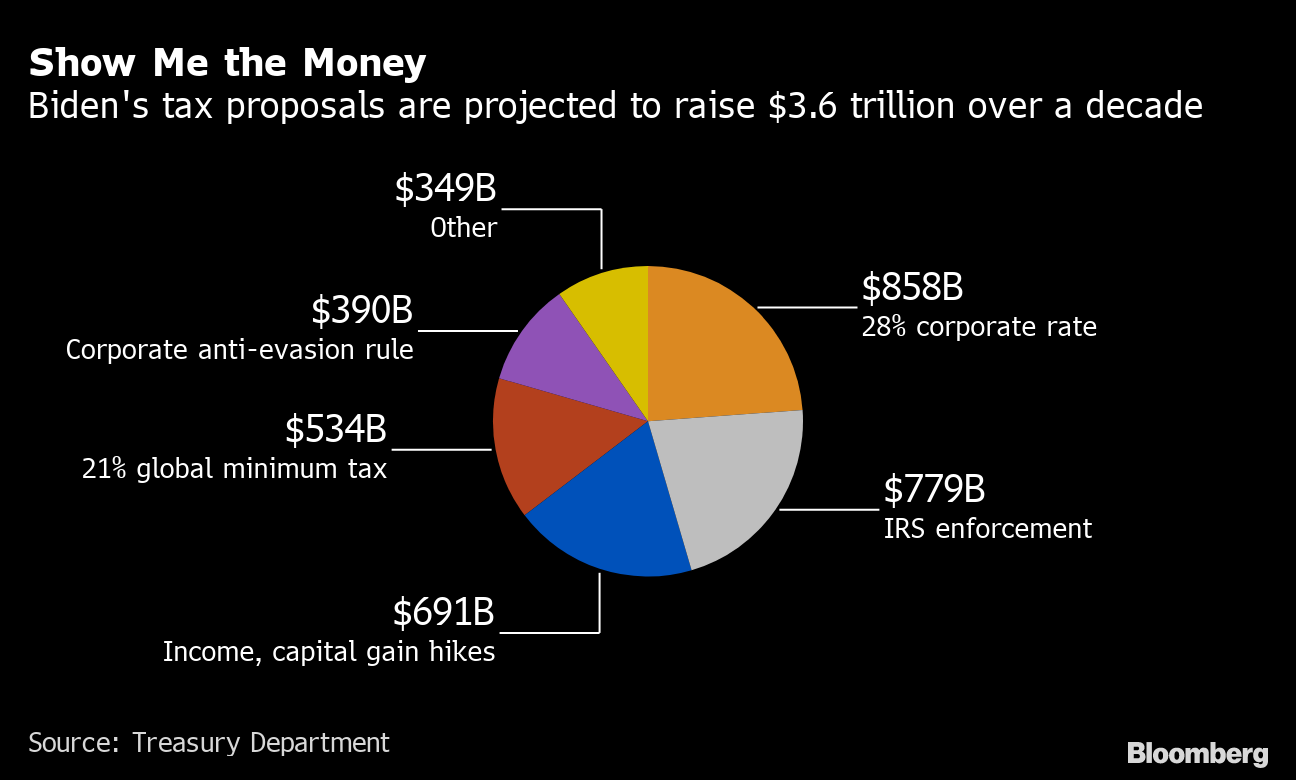

Biden Tax Plan Is Forecast To Bring In 3 6 Trillion Over Decade

Fat Valuations And Tech Stocks Seen As At Risk In Biden Tax Plan

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra